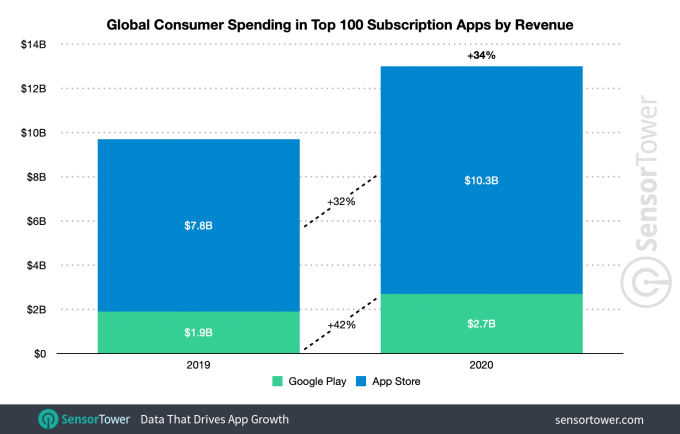

Apps saw record downloads and consumer spending in 2020, globally reaching somewhere around $111 billion to $112 billion, according to various estimates. But a growing part of that spend was subscription payments, a new report from Sensor Tower indicates. Last year, global subscription app revenue from the top 100 subscription apps (excluding games), climbed 34% year-over-year to $13 billion, up from $9.7 billion in 2019.

The App Store, not surprisingly, accounted for a sizable chunk of this subscription revenue, given it has historically outpaced the Play Store on consumer spending. In 2020, the top 100 subscription apps worldwide generated $10.3 billion on the App Store, up 32% over 2019, compared with $2.7 billion on Google Play, which grew 42% from $1.9 billion in 2019.

Image Credits: Sensor Tower

There are some signs that subscription revenue growth may be hitting a peak. (Or it could be that subscriptions were a luxury some consumers cut in a down economy.)

Globally, subscription app revenue from the top 100 apps was around 11.7% of the total ~$111 billion consumers spent on in-app purchases in 2020 — which is roughly the same share it saw in 2019.

And in the fourth quarter of 2020, 86 of the top 100 earning apps worldwide offered subscriptions, which was down from the 89 that did so in the fourth quarter of 2019.

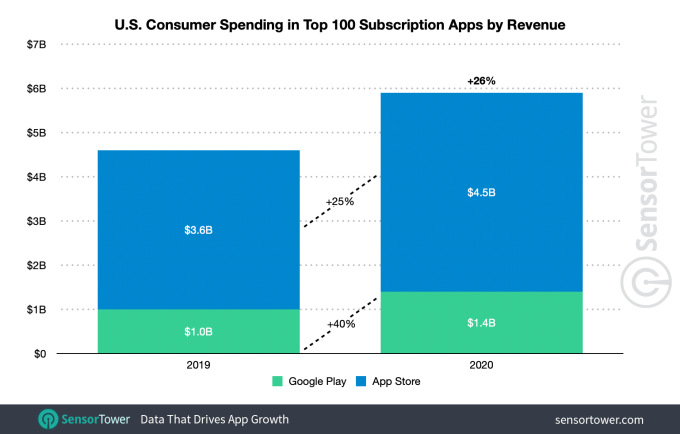

In addition, subscription app revenue growth in the U.S. is now trailing the global trends.

Although subscription app revenue was still up 26% on a year-over-year basis to reach nearly $5.9 billion in 2020, that was slower growth than the 34% seen worldwide.

Image Credits: Sensor Tower

What’s more, subscription app spending in the U.S. last year represented a smaller percentage of the total consumer spend than in 2019, the report found. In 2020, subscription payments from the top 100 subscription apps were 17.6% of the $33 billion U.S. consumers spent on in-app purchases, down from the 21% share they accounted for in 2019.

And out of the 100 top grossing apps in the U.S. in the fourth quarter 2020, 91 were subscription-based, down from 93 in the year ago quarter.

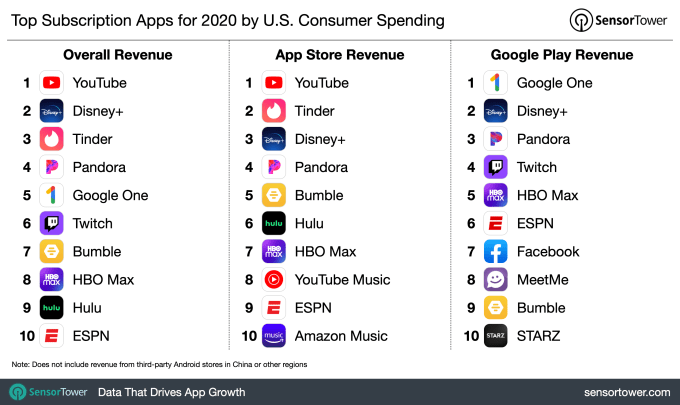

The top subscription apps in the U.S. looked different between the App Store and Google Play. On the former, YouTube was the top grosser in this category, while Google Pay users spent on Google One (Google’s cloud storage product). Tinder, meanwhile, was No. 2 on the App Store, while Disney+ took the second spot on Google Play.

Image Credits: Sensor Tower

Overall, the top 10 across both stores were YouTube, Disney+, Tinder, Pandora, Google One, Twitch, Bumble, HBO Max, Hulu, and ESPN. These top earners indicate that consumers are willing to pay for their entertainment — like streaming services — on subscription, but it’s more difficult for other categories to break into the top charts. Dating apps. however, remain an exception.